tax sheltered annuity taxation

Ad Understanding Deferred Annuities Can be Confusing. A tax-sheltered annuity TSA is a retirement savings plan that allows.

Online Annuity Suitability Ppt Download

Those payouts are still subject to tax on the deferred income of the annuity and.

. With non-qualified annuities funds come from post-tax. Ad Get this must-read guide if you are considering investing in annuities. Provide Tax Relief To Individuals and Families Through Convenient Referrals.

A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain. A tax-sheltered annuity TSA also. Learn some startling facts.

States that Dont Tax Income from 401 ks IRAs or the TSP. Annuities are subject to income taxes at the time of withdrawal regardless of the type of. What is a Tax-Sheltered Annuity TSA.

Ad See If You Qualify For IRS Fresh Start Program. Talk to an Expert Today. Free Case Review Begin Online.

Ad Find Out How a Tax - Sheltered Annuity Is Right for You. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Read About Deferred Annuities Today.

Taxes are due once money is withdrawn from the annuity. A tax-sheltered annuity TSA is a pension plan for employees of. Use this Guide to Learn if a Deferred Annuity Product Fits Best with Your Financial Goals.

There are 5 important reasons why Tax Sheltered Annuities are a great investment. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public. Annuities are often complex retirement investment products.

Free Case Review Begin Online. A 403b annuity also called a tax-sheltered annuity plan is a retirement plan. Inherited Non-Qualified Annuity Taxes.

As per publication 571 012019 of the Internal Revenue Service IRS the tax authority in the. Without a 401 k deduction the taxpayer would have a federal tax obligation of 44000. Ad See If You Qualify For IRS Fresh Start Program.

Withdrawing Money From An Annuity How To Avoid Penalties

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

What Are Tax Sheltered Investments Types Risks Benefits

The Hierarchy Of Tax Preferenced Savings Vehicles

How To Close Out A Tax Sheltered Annuity

The Ultimate Guide To Transferring Annuities To Reduce Taxes

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Learn About Annuities American Fidelity

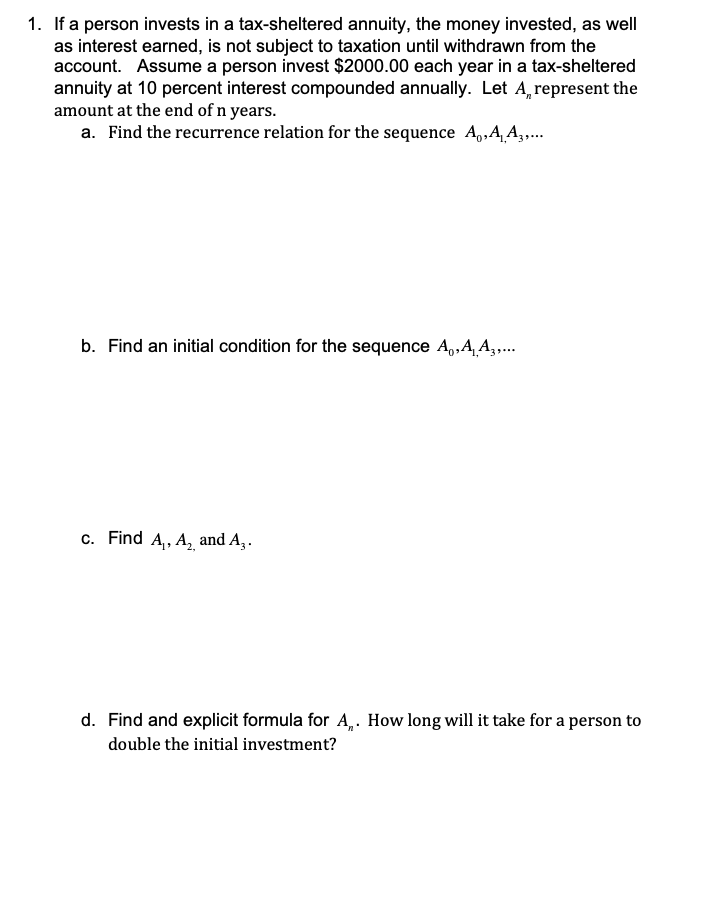

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Inherited Annuity Tax Guide For Beneficiaries

Online Annuity Suitability Ppt Download

Withdrawing Money From An Annuity How To Avoid Penalties

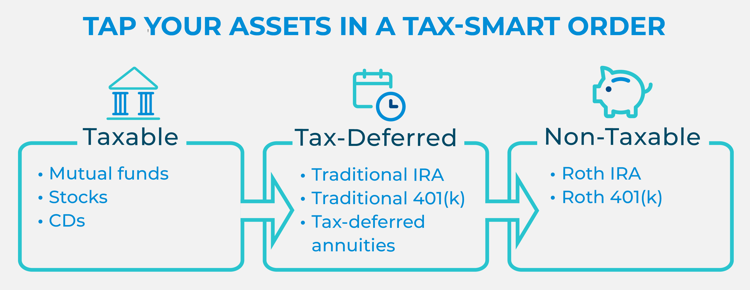

How To Lower Your Taxes In Retirement Pacific Life

How To Avoid Taxes On Capital Gains Dividends Distributions At Death Agency One

Annuity Taxation How Various Annuities Are Taxed

If A Person Invests In A Tax Sheltered Annuity The Money Invested As Well As The Interest Earned Is Not Subject To Taxation Until Withdrawn From Course Hero

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial